Many retirees or those pondering retirement know: sometimes it’s difficult to let go. After spending decades being hard-wired to go to work week-in and week-out—and in many cases enjoying it—just retiring cold turkey can be a lot to process. That’s why many people opt to “phase out” instead, incrementally weaning themselves away from work and towards retirement. Call it, a “gradual retirement.”

Many retirees or those pondering retirement know: sometimes it’s difficult to let go. After spending decades being hard-wired to go to work week-in and week-out—and in many cases enjoying it—just retiring cold turkey can be a lot to process. That’s why many people opt to “phase out” instead, incrementally weaning themselves away from work and towards retirement. Call it, a “gradual retirement.”

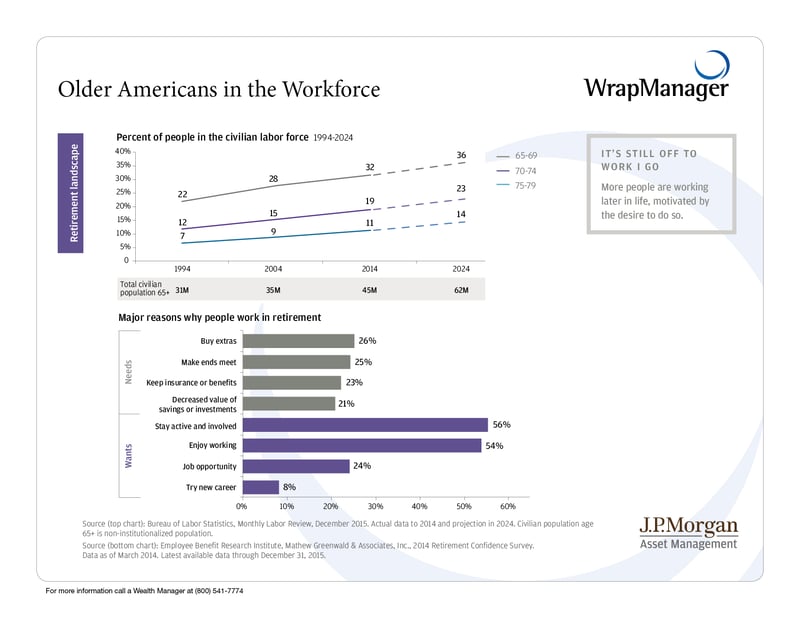

At WrapManager, we see this trend more and more with our clients, but there is also research to support the claim. JP Morgan looked at people aged 65 – 79, and shows that since 1994 there has been an increasing percentage of older people in the workforce. Some people work later to support themselves financially or to maintain insurance coverage, but JP Morgan’s research suggests that most stay in the workforce because they want to stay active and because they enjoy the work!

In a recent article we wrote about Social Security Retirement Income Strategies, we made the argument for delaying Social Security payments – if your financial situation allowed for it. A person with a full retirement age of 66 who claims Social Security at 62 receives 75% of the amount they’d receive at full retirement age, whereas a person with a full retirement age of 66 who waits until age 70 receives 32% more than he or she’d receive full retirement age. For a person that lives a long and healthy life, this could mean hundreds of thousands of dollars in additional benefits.2

Well, a “Gradual Retirement” may also be a means for a person to delay taking Social Security. If you can supplement your retirement income by staying in the workforce a little longer, forgoing the need to activate your Social Security retirement income, you can potentially get the best of both worlds—staying in the workforce and getting a boosted Social Security payment.

Just Don’t Forget to Have a Backup Plan

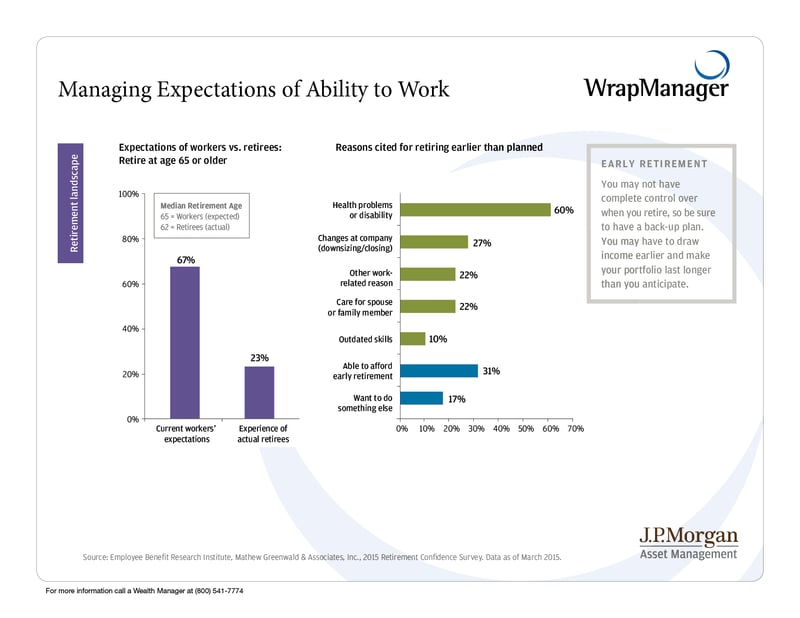

A gradual retirement may sound like an ideal outcome for those who really enjoy their work, but it’s not always a realistic one. Life happens, and sometimes the unexpected forces us to change course. Once again, JP Morgan research illustrates the point. They found that people currently working generally expect to continue work into retirement, but once they actually reach retirement age the expectation changes. There are a variety of reasons people retire earlier than planned:

At the end of the day, it is often times the “unexpected” that we have to plan for when we’re mapping out our financial futures. If you’re considering a gradual retirement, that means planning for the possibility of not being able to work well into retirement.

Make Sure Your Plan (and Backup Plan) is Solidly in Place

There are a lot of “either/or” scenarios that can surface as a person approaches retirement and plans for retirement. At WrapManager, one of our Wealth Managers can guide you through having an investment plan that’s designed to support your financial needs no matter what retirement road you choose. For a free evaluation of your investment plan, or to have a Wealth Manager be a sounding board for your ideas about retirement, please just give us a call at 1-800-541-7774. You can also reach us by email at wealth@wrapmanager.com.

Source:

1. JP Morgan - Guide to Retirement

2. www.money.cnn.com: Is 70 too late to claim Social Security?