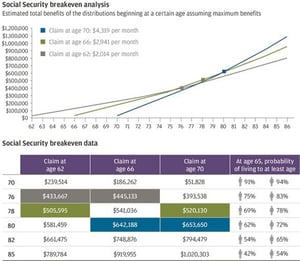

If there’s a good word to describe the state of Social Security in America, it might be something like “uncertain.” And that’s a far cry from the reliable, dependable safety net that many retirees and future retirees have come to expect of the program.

Many readers probably know where this is going – the familiar narrative that Social Security is underfunded, may run out of money soon, and may not be there for future generations. Even still, as the checks continue rolling in, the idea that Social Security is in trouble has a feeling of being far-fetched. For many, it feels like an issue that may indeed be true but doesn’t necessarily apply to you specifically.

First signed into effect by President Roosevelt on August 14, 1935, the Social Security Act created a social insurance program designed to pay retired workers over the age of 65 continuing income after retirement. Since then, tens of millions of people have received benefits through the Social Security Act. Yet, the program was wrought with challenges from the start, and experienced financial peril as early as 1977.¹

And, despite attempts to keep it solvent, the Social Security program faces a major long-term shortfall. Surprisingly though, a large number of Americans seem unaware of this looming failure.

[+] Read MoreRetirement Planning Social Security Benefits Retirement Income Strategy