U.S. investors are significantly under-allocated to international stocks, according to JP Morgan Asset Management. They found that even though 50% of the world’s equity market capitalization is found outside the US, investors have less than a third of their portfolios allocated abroad.1

U.S. investors are significantly under-allocated to international stocks, according to JP Morgan Asset Management. They found that even though 50% of the world’s equity market capitalization is found outside the US, investors have less than a third of their portfolios allocated abroad.1

This imbalance represents a significant disconnect between where the world’s growth is generated today versus where investor portfolios are allocated, and is especially magnified as investment prospects outside the US continue to improve.1

To address this investment issue, you should review your retirement plan’s international exposure with your financial advisor. Is your investment portfolio positioned for whatever growth opportunities may lie ahead in the international markets?

4 Attractive Features of International Investing Today

Growth prospects abroad appear to have a bright future ahead. Here are four reasons why.

1. International Stocks Valued Attractively, May Have Room to Run

Despite improving fundamentals and stronger corporate balance sheets, international stocks are still valued below their historical averages. As you can see below, international stocks have lagged the S&P 500 (US stocks) and are yet to reach their pre-recession highs, meaning they may have more room to grow over the long-term as conditions improve.1

Non-US Markets Have not Climbed Back to pre-Recession Highs, Unlike US Stocks

(Click chart for larger version)

Source: JP Morgan Asset Management. Standard and Poor’s, MSCI. Data as of 3/31/14. For illustrative purposes only. The chart shows the relative performance of U.S., EAFE and emerging markets stocks, including dividends, based on a common start date of October 9, 2007 — the pre-recession peak of the U.S. stock market. Initial values for all three market indexes are indexed to 100.

Source: JP Morgan Asset Management. Standard and Poor’s, MSCI. Data as of 3/31/14. For illustrative purposes only. The chart shows the relative performance of U.S., EAFE and emerging markets stocks, including dividends, based on a common start date of October 9, 2007 — the pre-recession peak of the U.S. stock market. Initial values for all three market indexes are indexed to 100.

2. Diversifying May Reduce Risk and Improve Performance

Since global equity markets do not move in lockstep, diversifying across countries can help lower portfolio volatility, while also providing you access to larger markets and broader opportunities.1 It’s a form of risk-managed investing.

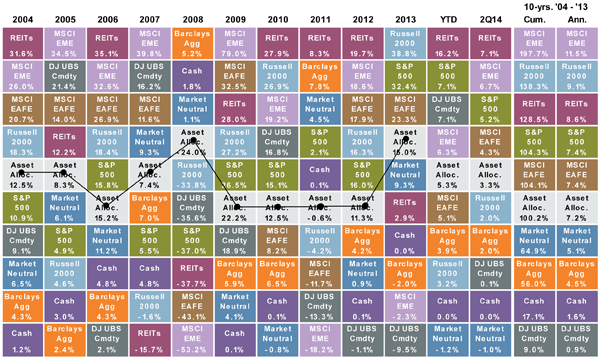

Diversifying internationally may also provide a boost to performance over time. Taking a look at the relative performance of the MSCI EME (Emerging Markets - Light Purple), the MSCI EAFE (Europe, Asia, & the Far East - Brown), and the S&P 500 (US - Green) over the last 10 years demonstrates that the U.S. is not always the best performer. In fact, there are many years like 2004, 2005, 2006, 2007, 2009, and 2012 when international stocks briskly outperformed US stocks.2

Historical Asset Class Performance

(Click chart for larger version)

Source: JP Morgan Asset Management. Russell, MSCI, Dow Jones, Standard & Poor’s, Credit Suisse, Barclays Capital, NAREIT, FactSet, J.P. Morgan Asset Management.The “Asset Allocation” portfolio assumes the following weights: 25% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI EAFE, 5% in the MSCI EME, 25% in the Barclays Capital Aggregate, 5% in the Barclays 1-3m Treasury, 5% in the CS/Tremont Equity Market Neutral Index, 5% in the DJ UBS Commodity Index and 5% in the NAREIT Equity REIT Index. Balanced portfolio assumes annual rebalancing. All data represents total return for stated period. Past performance is not indicative of future returns. Data are as of 3/31/14, except for the CS/Tremont Equity Market Neutral Index, which reflects data through 2/28/14. “10-yrs” returns represent period of 1/1/04 – 12/31/13 showing both cumulative (Cum.) and annualized (Ann.) over the period. Please see disclosure page at end for index definitions. *Market Neutral returns include estimates found in disclosures. Guide to the Markets – U.S. Data are as of 3/31/14.

In your investment portfolio, having exposure to international money managers during those years could help ensure your investment plan captures this outperformance.

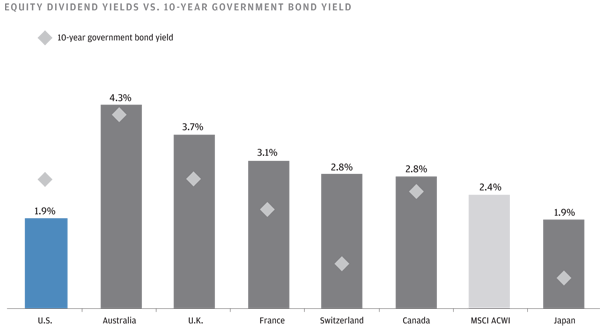

3. International Stocks Can Pay Higher Dividends Than U.S. Stocks

For those whose retirement plan is partly or fully designed to generate retirement income, international stocks could provide an additional source of cash. In fact, international stocks have tended to offer higher dividend yields than their U.S. counterparts:1

International Equities Can Offer Compelling Dividends Relative to Local Government Bonds

(Click chart for larger version)

Source: FactSet, MSCI, J.P. Morgan Asset Management. Yields shown are that of the appropriate MSCI index. Data as of 3/31/14. For illustrative purposes only.

4. Emerging Markets Growth Could Propel the World Forward

The International Monetary Fund expects that over half of global growth in the next 4 years will come from Emerging Markets. As populations in Emerging Markets continue to move to cities, they in-turn drive up demand for infrastructure, energy, technology, banking services, and so on. This creates a “virtuous circle” of economic growth, which presents opportunities to companies – and investors – with exposure to those markets.1

Yet, in spite of all this opportunity, JP Morgan research indicates that US investors have only 5% of their equity fund portfolio investments in Emerging Markets. This may present an opportunity for many investors to increase their portfolio exposure to these rapidly growing areas.

US Investors May Not Have Enough Emerging and International Markets Exposure

(Click chart for larger version)

Source: Standard & Poor’s, MSCI, FactSet, J.P. Morgan Asset Management. Totals may not sum to 100% due to rounding. Data as of 3/31/14. Right chart includes active mutual funds, passive mutual funds and ETFs, but excludes Morningstar Sector Stock categories. Pacific/Asia ex-Japan Stock category assets split 50% into Non-U.S. Developed and 50% into Emerging Markets. World Stock category assets split 50% into U.S. and 50% into Non-U.S. Developed. Non-U.S. Developed includes Foreign Large Blend, Value, Growth; Foreign Small/Mid Blend, Value, Growth; Japan Stock; Diversified Pacific/Asia; Europe Stock. Emerging Markets includes Diversified Emerging Markets; India Equity; China Region; Latin America Stock. Data as of 3/31/14. For illustrative purposes only.

What International Money Managers Do You Have In Your Investment Plan?

And when was the last time you checked your portfolio to see how you were allocated to international stocks?

The opportunity in international equities may be improving, so it is important to check that your portfolio is adequately positioned to participate in whatever future growth may lie ahead. One of our Wealth Managers can run an analysis of your portfolio to show you how much exposure you have to international stocks, and whether or not some rebalancing in your portfolio may be appropriate given your goals and our outlook. We can also share information with you about the international money managers we’re recommending today.

Get started with us today by calling 1-800-541-7774, or if you prefer to start a conversation over email, you can send us a note to Wealth@wrapmanager.com.

Sources:

2 JP Morgan Asset Management Guide to the Markets

Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards.