There was once a time when investing in the markets was as simple as choosing how much money to have in stocks, versus bonds, versus cash in the bank.

There was once a time when investing in the markets was as simple as choosing how much money to have in stocks, versus bonds, versus cash in the bank.

Since that time the investment landscape has evolved and the menu of investment options has grown, giving you several products like hedge funds, annuities, ETFs, mutual funds and private REITs. Unfortunately, many of these investments often lack transparency and come with hidden risks and inconsistent returns.

Take care in analyzing these three investments as you work with your financial advisor to plan your investment portfolio and retirement income plan.

Investment Options with Distorted Risk/Reward Properties

More investment options don’t always mean better ones, and there are several products today that carry high risks with questionable and often unproven rewards.

Below are three investment options that have gained popularity in recent years. The attraction to these investment products is partly because of the potential for high returns, but also because investors are eager to find alternatives to bonds as they search for retirement income sources and yield in the current low interest rate environment.

Unit Investment Trusts (UITs)

These are professionally selected, packaged portfolios of stocks, bonds, and/or other securities. UITs originally started as packaged portfolios of municipal bonds, but gained popularity as managers started customizing them with other types of assets.

The Risks and Why You Should Be Careful

-

Hidden Fees – UITs usually carry upfront sales charges, deferred sales charges, creation and/or development fees. There may also be set a maturity date which may encourage “rolling” clients from one UIT to another, prompting another sales charge

-

Unmanaged – once created, it lacks flexibility to changing market conditions

-

Liquidity Risk – some are thinly traded and can be costly to sell1

Non-Traded REITs

These pool the capital of investors to purchase a portfolio of income-producing real estate such as office buildings and shopping centers.

The Risks and Why You Should Be Careful

-

High Fees - Redemption fees can be high and erode total return. Front-end fees can be as much as 15% of the per share price

-

Illiquid - They do not trade on a national securities exchange, making them illiquid for longer stretches of time, generally 8 years or longer

-

Questionable Distribution Sources - The periodic distributions that are attractive to retirees looking to maximize retirement income can be heavily subsidized with borrowed funds2

Interest Rate Sensitive Products/Investments

These are investments that are sensitive to interest rate movements. Many are consider safe and normal in retirees’ portfolios, but others are especially sensitive to interest rates, such as long duration bond mutual funds and ETFs, or categorically high risk and low quality bonds.

The Risks and Why You Should Be Careful

-

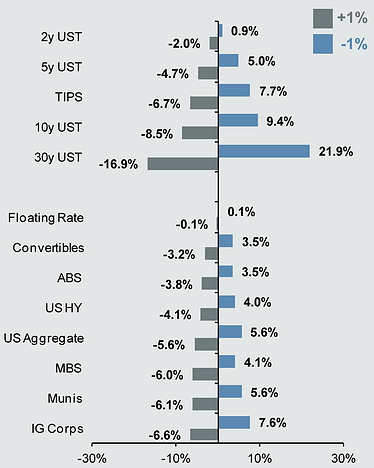

Even a slight movement in interest rates could hurt performance:

Price Impact of a 1% Rise/Fall in Interest Rates*

(Click chart for larger version)

Source: U.S. Treasury, Barclays Capital, FactSet, J.P. Morgan Asset Management. Change in bond price is calculated using both duration and convexity according to the following formula: New Price = (Price + (Price * -Duration * Change in Interest Rates))+(0.5 * Price * Convexity * (Change in Interest Rates)^2). *Calculation assumes 2-year Treasury interest rate falls 0.47% to 0.00%,as interest rates can only fall to 0.00%. Chart is for illustrative purposes only. Past performance is not indicative of future results. Guide to the Markets – U.S. Data are as of 6/30/14.

-

Uncertainty with Interest Rates - If interest rates start to rise, prices of bonds, especially long term bonds, could fall3

Alternative Ways to Approach Your Retirement Income Plan

Generally speaking, the investments above can be difficult to understand, lack transparency and have questionable fees.

If you’re looking for ways to maximize retirement income, we believe there are better, more efficient, and easier to understand ways to do it.

Our retirement e-book, “5 Ways to Enhance Your Retirement Planning Strategy,” gives a detailed view of other approaches to building a retirement income plan that can work for you and your family. Request your copy today by clicking here or calling one of our Wealth Managers at 1-800-541-7774.

Michael is a Certified Wealth Strategist and Wealth Manager at WrapManager, Inc.

Sources:

2 FINRA

Investment vehicle descriptions represent a brief overview meant for informational purposes only. This material does not represent a personalized recommendation and does not reflect individual investor’s risk and return goals nor does it serve as the receipt of, or a substitute for, personalized advice from WrapManager, Inc. or any other investment professional.