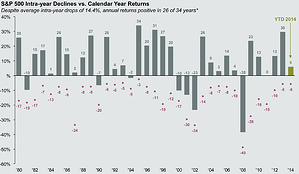

For all the talk there’s been over the last two-plus years of a looming stock market correction, one has yet to take hold. The S&P 500 had a banner year in 2013, is up this year +4.15% through August 1,1 and has been in a fairly steady climb since 2012. For two years, the market has resisted a correction in the 10% - 20% range.2 In July, however, the S&P 500 posted its first monthly loss since January, and on July 31 saw its biggest point drop since April.3 It’s possible this weakness marks the beginning of a stock market correction, though no expert can know with certainty. What we do know, however, is that corrections are a normal part of bull markets, and there are steps you can take when one occurs. What to Do During a Stock Market Correction Corrections are generally defined as relatively short-lived pullbacks in the market in the 10% - 20% range, something we haven’t seen since the summer of 2012. As you can see below, over the last 34 years the market experiences average intra-year declines of -14.4%. Past Stock Market Corrections and Declines (Click chart for larger version) Source: Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. *Returns shown are calendar year returns from 1980 to 2013 excluding 2014 which is year-to-date. Guide to the Markets – U.S. Data are as of 6/30/14.

[+] Read More