It’s the retirement planning topic that, candidly, cannot be overstated or discussed enough: planning for healthcare costs.

Crucial as this subject is, it arguably does not receive a proportionate amount of attention in retirement planning conversations around the country – which is ironic, given that retirees over the age of 65 are likely to spend a sizable percentage (~13% according to J.P. Morgan) of their total retirement income on healthcare.

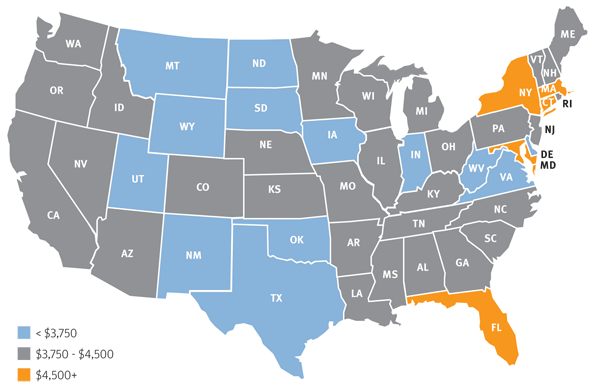

Let’s jump right into the numbers.

AARP has created a useful calculator for estimating healthcare costs in retirement, which you can access here: Estimate Your Healthcare Costs in Retirement.

[+] Read MoreRetirement Planning Healthcare in Retirement Saving for Retirement