We’ve all heard the term “don’t put all your eggs in one basket”. Of course, this concept can be easily applied to investing. Many sophisticated investors understand that investing in only one stock, or only one asset class, or only one anything is risky. However, the question of whether or not you should invest in just one money manager is rarely directly addressed.

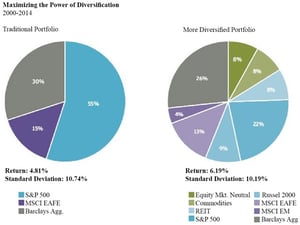

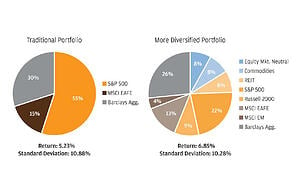

A key objective of diversified investing is to build a portfolio that is spread across multiple asset classes in an effort to lower the overall volatility of the portfolio.

If you invest your entire portfolio in one single stock it’s clear that your entire portfolio will be tied to the fortunes, and therefore risk of that one company. Adding additional investments to the portfolio can lower the overall volatility and risk of the portfolio, especially if you are adding additional holdings with low correlations to one another.

In other words, if your portfolio zigs, you want to add something that zags to get the most effective diversification benefit.

To take this further, if your portfolio is made up entirely of one large cap telecom stock, adding a second and third large cap telecom stock may give you little in the way diversification benefit if each of these companies have similar factors that drive their returns. Ideally, a portfolio will be well diversified among different sectors. That way, if one sector is performing poorly, this poor performance may be offset by other sectors with stronger performance. Likewise, geographical diversification is important to help mitigate the impact of a poorly performing market.

[+] Read MoreInvestment Planning Portfolio Diversification Portfolio Diversification Strategy