Editor’s Note: This article was written for the WrapManager Wealth Management blog by guest author Justin Sibears, a Portfolio Manager at Newfound Research. More information about Justin and Newfound can be found at the bottom of the article.

Slow failure in investing happens when portfolio returns are insufficient to generate the growth needed to meet your objectives. No one event causes this type of failure. Rather, it slowly builds over time. Think death by a thousand papercuts or your home slowly being destroyed from the inside by termites.

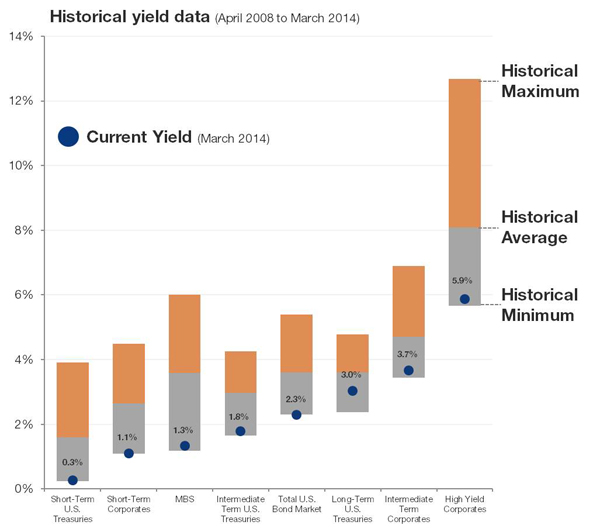

Traditionally, this type of slow failure was probably the result of taking too little risk. Oversized allocations to cash, which as an asset class has barely kept up with inflation over the last 90 years, are particularly likely to be a culprit in this respect.

[+] Read MoreRetirement Planning Newfound Research LLC Saving for Retirement